We go to school, we go to college, we study, we join a job with the hope that we'll get rich one day, but eventually we still live poor. What went wrong? Why do we stay still poor even though we earn?.

We lack financial knowledge.

But, the irony is no schools or no parents are teaching it these days. Did you see any school teaching how to manage money? That's why we earn money and not knowing how to manage it, we spend it vaguely. Then, How come there be many rich people in the world? They know the rules of money and how to manage it. The secret to getting rich is not earning, it's managing and knowing what to do with what you earn.

We lack financial knowledge.

But, the irony is no schools or no parents are teaching it these days. Did you see any school teaching how to manage money? That's why we earn money and not knowing how to manage it, we spend it vaguely. Then, How come there be many rich people in the world? They know the rules of money and how to manage it. The secret to getting rich is not earning, it's managing and knowing what to do with what you earn.

Financial knowledge is the key to getting rich. Without financial knowledge, even if we win a million-dollar lottery, we will still live poor. So, now you got the importance of financial knowledge, here are my 8 pieces of amazing financial advice to get rich.

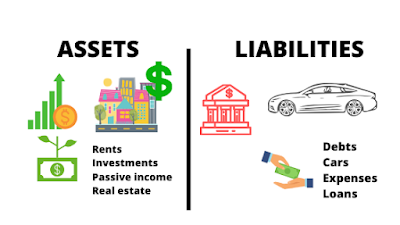

1. Know the difference between an asset and a liability:

Without knowing the difference between what's eating your pocket vs what's filling your pocket, you'd never learn how to manage money and get rich. This is the basic thing to know to manage your finances.

What are assets and liabilities actually?

Assets are the items that generate income and liabilities are the items that take away your income. To put it simply, what puts money in your pockets is an asset and what eats your pocket is a liability. We get rich if we have more assets and we get poor if we have more liabilities.

Examples of assets are:

Cash

Rental income

Real estate property

Investments

Bonds

Bonds

Passive income generating streams

Business etc

Examples of liabilities are

Your house

Car payments

Credit card payments

Credit card payments

Bank loans

Debts

Unnecessary subscriptions etc

Most people think their house is their asset, which is actually a liability. We spend a lot of money to build a house and maintaining it.

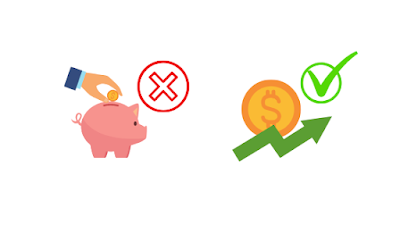

2. Don't just save:

We always hear advice from elder people like " Save money! Don't waste it". But I say you should not save money at all except to have some emergency funds for any fortuitous events. Saving money isn't gonna make you rich. I've never seen an individual get rich just by saving money. So, don't just save. Invest it and try to make it multiple. Saved money is like dead money, you don't use it, no one will use it. Keep the money flowing to generate more income. Invest it cleverly in real estate or stock market and try to make money with your saved money.

3.Have multiple streams of income:

Do you think Jeff Bezos, the richest person in the world or Mukesh Ambani became the richest person in India or any other rich person became so rich by just one source of income? No, they all have one thing in common, they have multiple sources of income. Expand your horizons in generating income. Explore new methods to multiply your money and invest in them. Build your financial portfolio with different streams of income-generating things. I suggest mostly focus on passive income because passive income is like money working for you instead of you working for money.

4. Take risks:

Most of us are afraid to take risks but in order to get financial freedom and to get rich, you need to take some hard choices and choose some eccentric paths which no one would walk. Risks are frightening but the returns will be rewarding if you take calculated risks. Save some money, learn about investing and stock markets or real estate, and then invest your money. I know people say stock markets and real estate are risky, but they are very lucrative when you have a goddamn plan and take a calculated risk with your money.

Risking money for freedom is okay, but not your freedom for money

5. Avoid debts:

If your goal is to achieve financial freedom and get rich, never ever get into bad debts. I said explicitly bad debts because these are the kind of debts that we do for frivolous reasons. Taking a loan to start a business is okay but making debts to have earthly pleasures is a blunder. Never make debts that you think are hard to repay.

6. Don't work for money:

Don't just work for money, work to improve your skills and money will follow. When you start to work only for the money you'll never get above that, you only think from the perspective of a 9-5 employee. But becoming rich isn't just a 9-5, no one ever became rich by working 9-5, work for yourself, your dreams and money will follow. I know money can solve a lot of your problems, but you never stay long is a place where you only seek money. The only way to get super-rich is to make money work for you.

Poor people work for money, Rich people make money work for them -Robert T. Kiyosaki

Develop the mindset of rich and attract wealth into your life.

Read How to attract anything you want in your life?

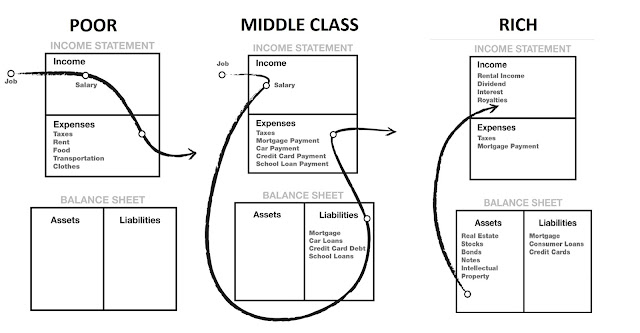

Well, kudos to you that you've read this long. Here's my bonus for you. This is an excerpt from Rich Dad Poor Dad book which tells you the difference between the cash flow of poor, middle class, and the rich.

As you can clearly see, the differences in the asset column are what makes a huge difference.

I highly recommend you to read the book RICH DAD POOR DAD by Robert T Kiyosaki. It'll enlighten your financial knowledge to new horizons.

I want to give away the ebook for free, subscribe to our mailing list and get Rich Dad Poor Dad and many other amazing ebooks sent directly into your inbox.

Thank you for reading and tell me if this article helped you or not in the comments section.

Have a fantastic day :)

Read How to attract anything you want in your life?

7.Understand Taxes:

Taxes are the most important aspect of managing finances. When you pay 30% of your income on taxes, what were you left with? The more you procure, the more assessment you pay. But taxing is different for employees and corporations. Employees earn and they get taxed and live with what's left whereas corporations earn, spend everything they can, and get taxed on the leftover. Imagine that you have a corporation and you reinvest all your income and you left with nothing to get taxed and all you invested will accumulate in your asset column. This is the manner by which the rich get more extravagant and the poor get less fortunate.8. Give and receive:

This is a simple rule of life. It applies very well to money too. What do I mean by give and receive here is, invest, and get returns. Without any investments, you can never get money. Probably sometimes it's not your money you invest, maybe it's your time or your skills. But never expect anything in return without investing anything. Free money is a fantasy that'll never come true.Well, kudos to you that you've read this long. Here's my bonus for you. This is an excerpt from Rich Dad Poor Dad book which tells you the difference between the cash flow of poor, middle class, and the rich.

As you can clearly see, the differences in the asset column are what makes a huge difference.

I highly recommend you to read the book RICH DAD POOR DAD by Robert T Kiyosaki. It'll enlighten your financial knowledge to new horizons.

I want to give away the ebook for free, subscribe to our mailing list and get Rich Dad Poor Dad and many other amazing ebooks sent directly into your inbox.

Thank you for reading and tell me if this article helped you or not in the comments section.

Have a fantastic day :)

2 Comments

Impressive thankss

ReplyDeleteThank you & keep supporting

DeleteTell me how you felt reading this article.